Many consumers are searching for credit cards that give discounts on fuel bills as the cost of fuel continues to grow annually. Although many cards eliminate the monthly fuel surcharge, certain cards are designed particularly to nee fuel- related requirements.

With the help of these cards, you can save money through co-branded advantages, expedited reward points, cash back, and more. You may greatly reduce lower tour fuel expenses and receive free fuel tear with the best fuel credit card. Prominent card issuers such as SBI Card, Axis bank, HDFC Bank, indusind bank , and others offer some of the Best fuel credit cards available in India.

How to choose the Best Fuel Credit Card?

- Repayment pattern – finding the payment pattern is the most important phase in selecting

- the Best Fuel Credit Card, The person needs to search for a credit card that provides both the best rate on interest and fuel advantages.

- Spending pattern – the person must assess their monthly spending and determine how much money will go toward fuel. This is crucial since obtaining a fuel credit card without first doing this analysis would be pointless.

- Fees & Charges – before obtaining the card, one needs to analyze all the costs and fees related to the fuel credit card they choose to obtain. If this isn’t done, paying large fees and penalties related to the card could offset the advantages and savings offered by fuel credit cards.

- Check Reward Redemption Process – it is advisable to review the best fuel credit card redemptions process. Obtaining cards that allow for instant point redemption is preferable.

- Connecting Oil Companies – When searching for a fuel credit card this is among the most important factors to consider. Make sure the benefits are available at all station in the whole country or just at specific stations operated by a single oil company.

The best fuel credit cards for petrol in India are listed here to assist you save more money on fuel purchases.

Best Fuel Credit Card List

BPCL SBI Card Octane

Joining Fee One Time INR1499.

Renewal Fee Waived spends on 2 Lakh.

Required Credit Score 750.

Key Features

- Enjoy the freedom to avoid paying the 1% fuel surcharge at all BCPL statins in India for transactions up to Rs. 4000, which does not include GST or other fees.

- Saving Rs. 1200 annually A maximum fuel price waiver of Rs. 100 per statement cycle is offered.

- Get 25 Reward points for every Rs. 100 spent at Bharat Gas, BPCL fuel, and Lubricants (only on the website and App),

- Get 10 Reward points for every Rs. 100 spend on dining, groceries, movies, and department stores (maximum of 7500 Reward points each month).

- Get 7.25% value back and earn up to 25X Reward points when you fuel at BPCL stations. Reward points are limited to 2500 every billing period.

- 6.25% + 1% Waiver of fuel surcharge on All BCPL Transactions Up to Rs. 4000 ( GST and other Taxes not included).

**It’s best fuel credit card but not Usable for UPI.

Indian Oil Axis Bank Credit Card

Joining Fee One Time INR500.

Renewal Fee Waived spends on INR 50000.

Required Credit Score 750.

Key Features

- Earn 100% cash back up to Rs. 250 on first fuel transactions performed on your credit card within first 30 days of card issuance.

- benefit of 4% value back on fuel transactions by earning 20 reward points per Rs 100 sent at an Indian oil petrol pump in India,

- Transaction on IOCL fuel outlet between Rs 100 to 5000 every month to for this offer,

- Benefit of 1% value back on online shopping by earning 5 point reward per Rs 100 spent,

- Transaction at online merchant’s between Rs100 to Rs 5000 to avail this offer,

- Maximum eligible spends per statement month Rs 5000.

- Get 1% surcharge waiver of fuel use on Fuel spends in India at any fuel outlet between Rs200 to Rs 5000 to avail this offer.

- 10% instant discount for movie ticket booked via Bookmyshow Website.

- Up to 15% discount on partner Restaurants via EazyDiner.

** it’s Best fuel credit card usable via UPI Apps.

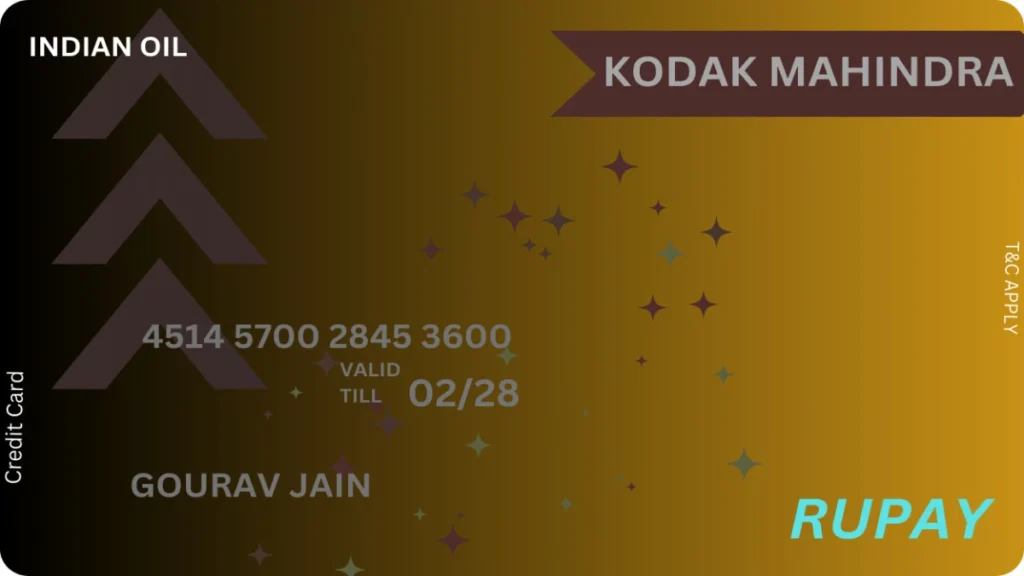

Kodak Royale Signature Credit Card

Joining Fee One Time Nill.

Renewal Fee Waived spends on INR 1 lakh.

Required Credit Score 700.

Key Features

- As a welcome reward, earn 1000 additional reward points after spending Rs 500 within 30 days of the card’s issuance.

- 24 reward points on every Rs150 spent (up to 1200 reward points in a month) on Indian Oil fuel station across India.

- 1% fuel surcharge waiver on transactions between Rs100 to Rs500, Rs100 per statement cycle only any Indian Oil Outlets.

- Up to 800 reward points each statement cycle, 12 reward points are awarded for every Rs 150 spend on dining and groceries.

** it’s Best fuel credit card usable via UPI Apps.

HDFC Bharat Credit card

Joining Fee One Time INR 500.

Renewal Fee Waived spends on INR 50000.

Required Credit Score 700.

Key Features

- Get 5% of your monthly purchases made on PayZapp, EasyEMI, and SmartBuy back. Maximum Cash back of Rs, 150 every month.

- Earn 5% monthly cash back on groceries, gas and IRCTC purchase (IRCTC Web & App) maximum cash back of Rs. 150 per month.

- Save up to 250 every billing cycle and avoid paying a 1% surcharge ( minimum transaction of Rs. 400).

- Complimentary accidental death insurance up to 50 Lack.

- The cash back will be recorded in the next billing statement and saved as reward points, on client request; it can be redeemed as cash back against the amount of the statement (1 point = 1 Rs).

- Reward point redemption for cash back will be limited to 3,000 rewards points every calendar month as of February 1, 2023.

- Beginning on February 1, 2023, cardholders will be able to use their reward points to redeem up to 70% of the value of certain products or vouchers, with credit cards being used to cover the remaining balance.

**Wallet loading won’t be taken into account for cash back.

** it’s best fuel credit card but not usable in UPI

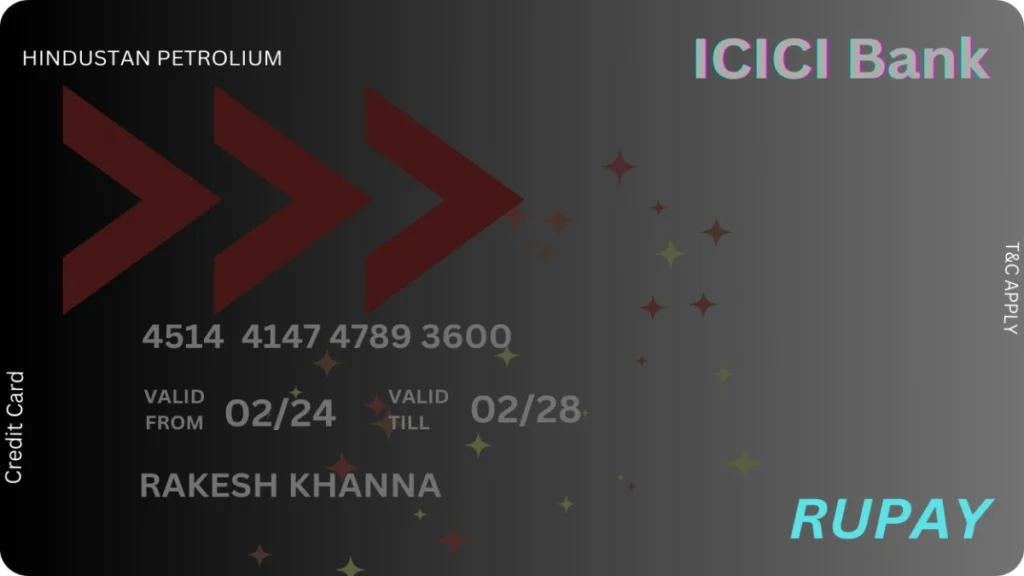

ICICI HPCL Super Saver Credit Card

Joining Fee One Time INR 500.

Renewal Fee Waived spends on INR 150000.

Required Credit Score 750.

Key Features

- 4% cash back of up to Rs 200 per month on fuel purchases at HPCL stations.

- 5% back as reward points max 400 points per months on grocery, departmental stores and utility spends, including government transactions.

- 2 Reward points on each INR 100 spent on retail purchases, expect fuel, departmental store and utility.

- INR100 cash back on HP Pay App on successful Recharge transaction pf at least Rs.1000.

- 1% cash back on fuel surcharge applicable on all fuel spends of up to Rs. 4000, , additional 1.5% back as Loyalty points in HP Pay App on Fuel.

** it’s Best fuel credit card usable via UPI Apps.

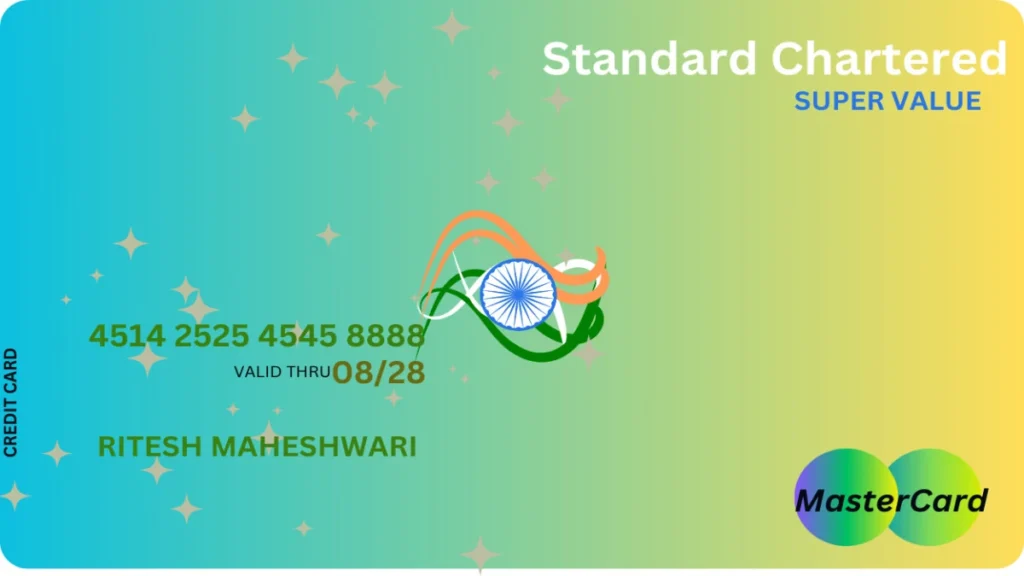

Standard Chartered Super Value Titanium Credit Card

Joining Fee One Time INR 750.

Renewal Fee Annually INR 750.

Required Credit Score 735.

Key Features

- Welcome cash back up to 1500 on fuel transactions within the first three months.

- Up to INR 200 per month, you can receive 5% cash back on purchases t ant petrol stations (maximum payback of INR 100 per transaction), all purchases totaling INR 2000 or less are qualified for cash back.

- Get 5% back when you pay your utility bills with card. You can earn a maximum cash back sum of Rs. 100 per month, with a minimum transaction amount of just INR 750 (max cash back INR 100 per transactions ).

- For any transaction above INR 750 you can receive a nice cash back of 5% on your phone bills (max rebate INR 100 per transaction).

- You receive one reward point for every INR 150 you use your credit card for in others purchases use your reward point to treat yourself to discounts, coupons, and other amazing deals from catalog.

** it’s best fuel credit card but not usable in UPI

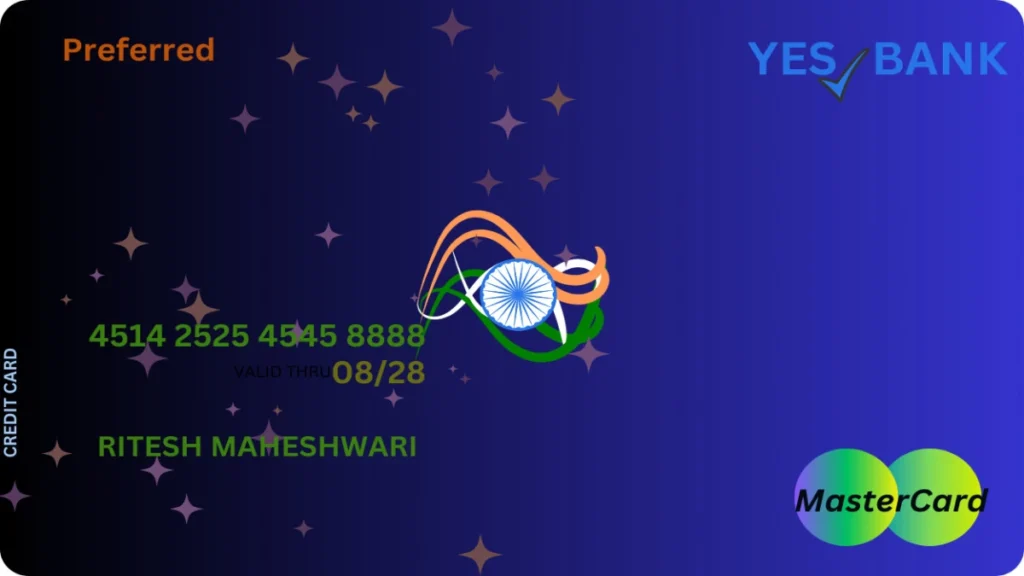

Yes First Preferred Credit Card

Joining Fee One Time INR 999.

Renewal Fee Waived spends on INR 2,50,000.

Required Credit Score 700.

Key Features

- 1% fuel surcharge waiver across all fuel stations in India for transactions between INR 400 and INR 5,000.

- 4 reward points per INR 200 spent on select categories utilities, groceries, tax payments, insurance sales, etc.

- 8 reward points per INR 200 you spent on every others retail purchase 16 reward points per INR 200 spent on travel and dining spends.

- Enjoy 4 complimentary Airport lounge accesses (Priority pass membership) and Golf lesson every month at select golf course across the country.

** it’s best fuel credit card but not usable in UPI

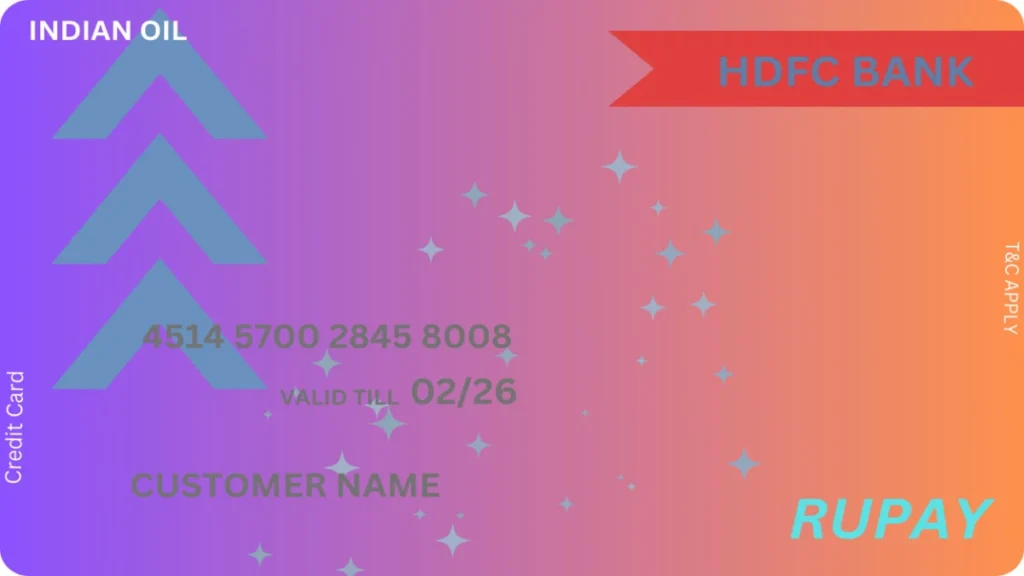

Indian Oil HDFC Bank Credit Card

Joining Fee One Time INR 500.

Renewal Fee Waived spends on INR 50,000.

Required Credit Score 750.

Key Features

- Earn 5% of spends as Fuel Points on Indian Oil fuel station

- Surcharge waiver of 1% on all fuel transactions

- Annual fee of 500+GST waiver if annual spends exceed Rs 50,000 in the previous year.

- On Indian Oil petrol pump Get upto 250 fuel reward points every month for the first 6 months and post 6 months get 150 fuel reward points.

** it’s Best fuel credit card usable via UPI Apps.

Conclusion

Best fuel credit card for fuel in India present a compelling solution for individuals looking to optimize their driving expenses.

With cost savings, rewards programs, and convenient transactions, these cards offer tangible benefits that extend beyond the petrol pump.

By understanding how to choose, use, and maximize the advantages of best fuel credit cards, individuals can embark on a journey to more economical and rewarding driving experiences.

Frequently Asked Questions (FAQ)

What are benefit of fuel credit card?

Ans – On top bank credit cards not only you will get cash back on fuel but also on every transaction on uses of your credit card everywhere like grocery online shopping bill payments, utilities.

What is the best credit card to use for fuel?

Ans – as above describe best fuel Credit Card stands out as the best choice for fuel expenses. Offering unmatched benefits, including substantial cash back and reward points on fuel transactions, it combines convenience with savings. Elevate your fueling experience with a credit card designed to maximize rewards and minimize costs.

What’s the best fuel card to get?

Ans. Rupay cards emerges as the ultimate choice for fuel savings. With generous discounts additional perks like dining rewards, it transforms everyday purchases into substantial savings. Elevate your fueling experience with a card designed to maximize benefits and fuel your journey with savings.

Are fuel credit cards worth it?

Ans. Absolutely! Top Fuel credit cards are worth it for savvy consumers. They offer exclusive benefits like cash back, rewards, and discounts on fuel purchases, translating into substantial savings.

2 thoughts on “Best Fuel Credit Card”