So, you’ve received your shiny new Union Bank credit card in the mail, ready to embark on a world of financial possibilities. But wait, how do you actually activate it? Don’t worry; we’ve got you covered. In this blog post, we’ll walk you through the simple steps to activate your Union Bank credit card hassle-free.

Here’s we will gives you best answer of your “How to Activate Your Union Bank Credit Card ” questions

How to Activate Your Union Bank Credit Card Step by Step Guide

How do I activate my Union Bank credit card

A: Activating your Union Bank credit card is a straightforward process. It can be activated over the mobile phone or online.

1. Online Activation:

Through Union Bank Mobile App: If you prefer using an app, you can activate your card through the Union Bank Mobile App. Here’s a general guideline (assuming the app offers card activation):

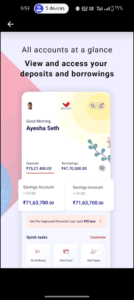

- Download and install the Union Bank Mobile App on your smartphone or tablet if you haven’t already.

- Open the mobile application and enter your login information.

- Look for a section related to credit cards or card activation.

- To activate your credit card, follow the instructions on the mobile screen, This might involve entering your card details and setting up a PIN.

2. Phone Activation:

- By SMS: This is a quick and convenient option. Here’s what you need to do:

- Make sure you have your new Union Bank Credit Card and a mobile phone registered with the bank.

- Send an SMS to 7836884400.

- In the message body, type CARDACKW XXXX (replace XXXX with the last four digits of your credit card number).

Q: Is there a specific time frame within which I need to activate my Union Bank credit card?

A: While it’s recommended to activate your credit card as soon as you receive it, there’s typically no strict deadline for activation. However, it’s best to activate it promptly to avoid any potential issues or delays in using your card for purchases.

Q: What information do I need to activate my Union Bank credit card?

A: To activate your Union Bank credit card, you’ll typically need the following information:

– Your credit card number

– The card’s expiration date

– The CVV (Card Verification Value), which is usually located on the back of the card

Q: Can I use my Union Bank credit card before activating it?

A: No, you cannot use your Union Bank credit card for purchases until it has been activated. Activation is necessary to verify your identity and ensure the security of your card.

Q: In case that there are any problems with the activation process, what should I do?

A: If you encounter any difficulties or have questions while activating your Union Bank credit card, don’t hesitate to reach out to Union Bank’s customer service team for assistance. They’ll be happy to help resolve any issues and ensure your card is activated promptly.

Conclusion:-

Activating your Union Bank credit card is a simple and essential step that allows you to start using your card for purchases and transactions. Whether you choose to activate it online or by phone, the process is quick and convenient, ensuring you can enjoy the benefits of your new credit card without any delays.

If you have any further questions or concerns about activating your Union Bank credit card, don’t hesitate to contact Union Bank’s customer service team for assistance. Now, go ahead and unlock the convenience and flexibility that comes with your new credit card!

Muthoot Finance Gold Loan

Gold. A precious metal coveted for centuries, it adorns our bodies and holds a place in our financial reserves. But

Indian Bank Gold Loan

Indian Bank provides comprehensive details about its gold loan offerings, including eligibility criteria, documentation requirements, processing fees, and repayment terms.

How to Improving Your Credit Score

In the world of personal finance, your credit score is your golden ticket. It’s the magic number that can either

Union Bank Gold Loan Interest Rate

Union Bank is one of the leading banks in India which provides gold loan services to its customers as per

FAQ’s Related to: How to Activate Your Union Bank Credit Card

How to do union bank credit card payment?

Union Bank of India offers several ways to make your credit card payment. Here are your options:

Online Payment Methods:

Net Banking (NEFT/IMPS/RTGS): You can use your existing bank account to transfer funds online. Use your Union Bank Credit Card’s 16-digit number as the beneficiary account number and UBIN0807826 as the IFSC code.

Union Bank Mobile App (if available): If the app has a credit card payment section, you can use it for quick payments.

UPI: Utilize a UPI mobile app like BHIM, Google Pay, or PhonePe to pay using your Union Bank Credit Card’s Virtual Payment Address (VPA). You can find your VPA on your monthly credit card bill or through the AB Credit Card Mobile App (if available).

BillDesk Payment Gateway: Union Bank offers a dedicated BillDesk portal for credit card payments https://pgi.billdesk.com/pgidsk/pgmerc/ubicard/UBI_card.jsp.

Offline Payment Methods:

Branch Banking: Visit any Union Bank branch and make a payment by mentioning your card number and amount.

Through ATM: You can pay through select Union Bank ATMs using your credit card.

1 thought on “How to Activate Your Union Bank Credit Card”